Greece Bans ATM Withdrawal Fees at Bank Networks Starting August 11

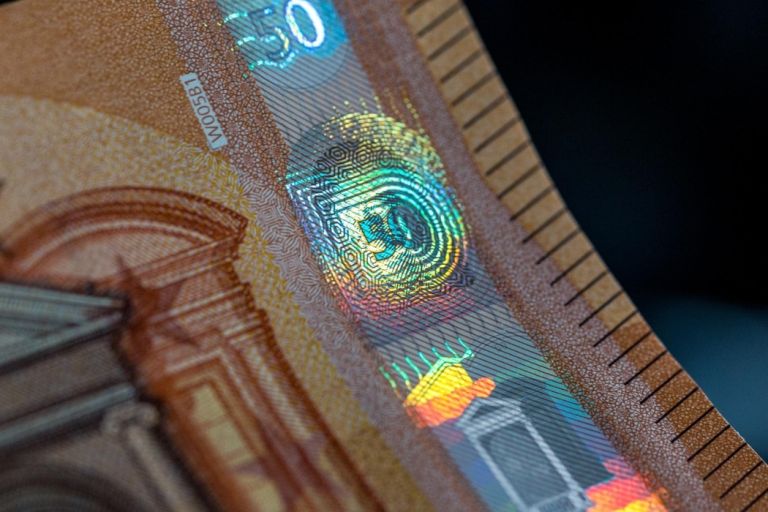

Πηγή Φωτογραφίας: Pixabay//Greece Bans ATM Withdrawal Fees at Bank Networks Starting August 11

In a landmark move toward consumer financial relief and fair banking practices, Greece’s Ministry of National Economy and Finance announced that, starting August 11, 2025, all ATM cash withdrawals from bank-operated networks will be entirely fee-free.

At the same time, a nationwide cap of €1.50 per transaction will be enforced on ATMs operated by third-party providers, while remote and single-ATM communities will see zero fees altogether—regardless of the ATM’s ownership.

“This is about restoring trust and predictability in everyday banking. It’s time the rules served citizens—not the other way around,” said Minister Kyriakos Pierrakakis, presenting the reform as part of a broader initiative to curb abusive fee structures across Greece’s fragmented ATM ecosystem. A Fee-Free Future – But Not for Everyone

Under the new law, bank customers will be able to:

- Withdraw cash from any ATM owned by Greek banks without paying a fee

- Use ATMs in rural areas with no alternative machines without incurring a charge, even if the ATM belongs to a private provider

- Pay no more than €1.50 when using non-bank ATMs in all other areas

This includes machines run by private fintechs or non-banking entities, which have been criticized for charging up to €3.50 per withdrawal in recent years—often in tourist zones or remote towns.

New Rules, Clear Limits

The law, enshrined in the amended Article 48 of Law 5167/2024, introduces strict definitions and regulatory boundaries:

- Applies to all payment service providers with headquarters or operations in Greece

- Regulates private companies and legal entities managing ATM networks

- Covers cash withdrawals, account balance inquiries, prepaid card reloads, and recurring digital payments

Additionally, inbound and outbound SEPA money transfers will carry a maximum fee of €0.50 per transaction for individuals and small businesses—capped at €5,000 per day.

“The financial system must work for citizens, not exploit geography and exclusivity,” a senior finance official remarked. “This legislation guarantees access to cash without economic discrimination.”

ATM Reform in Context

For years, ATM fees in Greece have varied wildly, especially in non-urban areas and island communities. With the country hosting over 10 million active debit cards, and cash remaining dominant in small business transactions, the reform aims to eliminate structural disadvantages for vulnerable groups, including:

- Pensioners

- Self-employed professionals

- Residents in one-ATM towns or remote islands

- Tourists unaware of hidden surcharges

A Digital Push with Physical Fairness

While Greece has aggressively promoted digital banking and e-payments in recent years, the government acknowledges that cash remains essential for:

- Daily needs in cash-based markets

- Elderly citizens with low digital literacy

- Rural populations with limited online access

Thus, the new law strikes a balance between encouraging digital finance and protecting access to physical money.

What Happens Next?

The implementation clock is ticking:

- All provisions become active on August 11, 2025

- ATM operators must update fee structures and transparency displays

- Financial watchdogs will conduct compliance audits and enforcement

A First Step Toward Broader Reform?

Economists view this move as a significant precedent in the re-regulation of retail banking fees, amid growing scrutiny from EU institutions. Some insiders speculate it could lead to:

- Pan-European harmonization of ATM fees

- Stronger consumer rights directives at the ECB level

- A shift toward fee transparency legislation for all retail banking services

“It’s not just about €1.50,” said a source close to the Ministry. “It’s about reclaiming public space in financial infrastructure—and ensuring access, fairness, and dignity with every transaction.”

Source: pagenews.gr

Διαβάστε όλες τις τελευταίες Ειδήσεις από την Ελλάδα και τον Κόσμο

Το σχόλιο σας