Thessaloniki Economic Showcase to Feature Tax Overhauls, Targeted Benefits

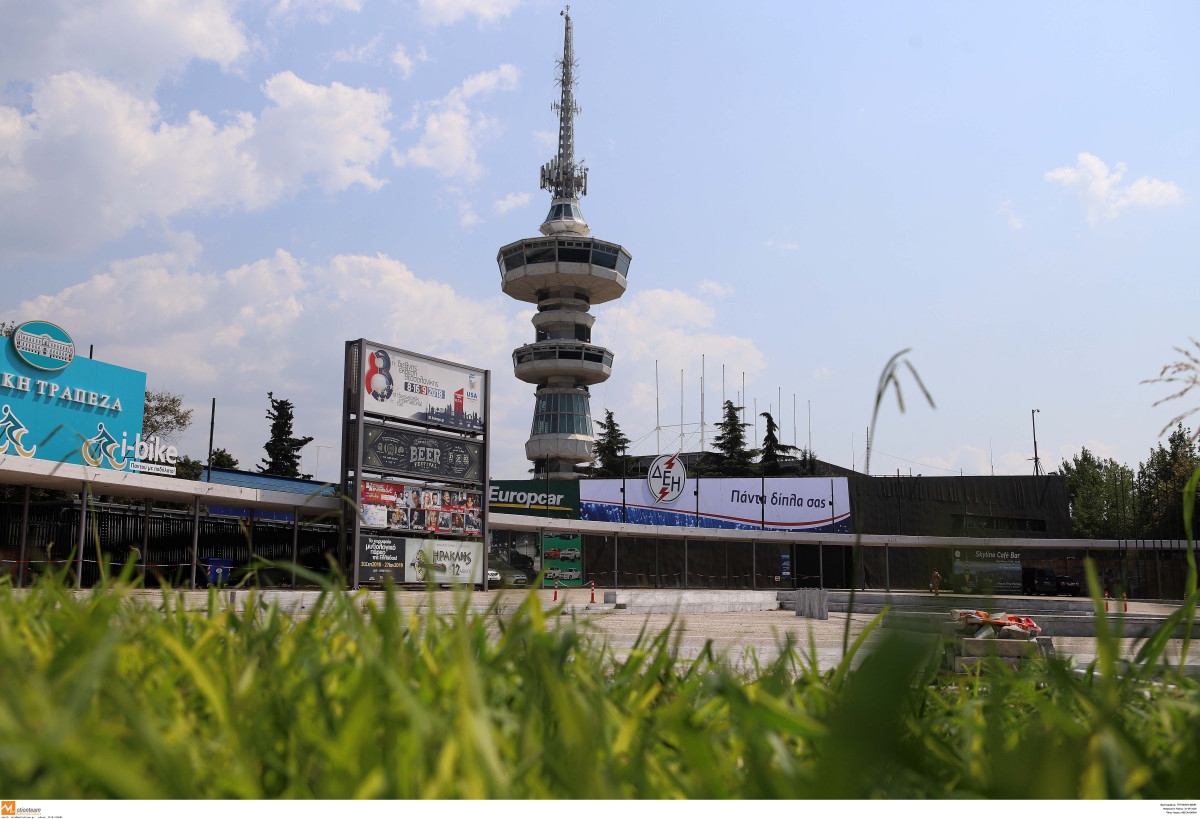

In less than five weeks, Greek Prime Minister Kyriakos Mitsotakis will take the stage at the 89th Thessaloniki International Fair (ΔΕΘ) to unveil a highly anticipated economic relief package, focusing on tax breaks, income support, and structural reforms aimed at offsetting years of high contributions from workers, pensioners, farmers, and self-employed professionals.

The announcement comes at a critical time for the administration, as it seeks to both reclaim political momentum and channel fiscal overperformance into targeted public support.

Tax Bracket Reconiguration in the Works

After five years of stagnation, the tax scale is about to shift.

The government’s economic team is finalizing changes to the income tax brackets, with particular attention on the second tier, currently taxed at 22% for incomes between €10,000 and €20,000. That bracket is expected to be split into two or more segments with lower rates, offering tangible relief to middle- and lower-income earners

“The aim is a fairer and more progressive distribution of tax burdens,” says a senior official at the Ministry of Finance.

The changes are planned to take effect in 2026, meaning wage earners and pensioners will see higher take-home payfrom January 2026, thanks to reduced withholding. Freelancers and business owners will benefit later, when they file tax returns in 2027.

Boosted Incentives for E-Receipts and Household Expenses

A major expansion is planned for the 30% tax deduction scheme for declared expenses in selected sectors such as home maintenance, childcare, transport, cleaning services, and veterinary care.

The scheme, currently in place for tax years 2022–2025, is expected to be broadened and extended by at least three more years, encouraging receipt collection and curbing tax evasion.

Rent Taxation Overhaul: Relief for Property Owners

One of the most impactful reforms will target taxation on rental income, especially for smaller landlords. Current rates—15% on annual income up to €12,000—are likely to drop by as much as 50%, potentially hitting as low as 5–7.5%.

For annual rental income between €12,000 and €35,000, where the rate is a steep 35%, an intermediate bracket will be introduced, ensuring gradual progression and avoiding tax cliffs.

Family-Centered Measures: New Allowances and Incentives

A series of family-friendly policies is also under discussion. These include:

- Higher tax-free thresholds for households with children

- Special grants for vulnerable families

- New incentives to acquire housing or vehicles, subject to fiscal space

Property Tax (ENFIA): The Waiting Game

Two opposing views persist within the government regarding the ENFIA property tax. While one camp argues against any changes due to its reliable revenue generation, the more probable scenario includes targeted reductions, depending on budget flexibility.

Regardless of the outcome, it has already been decided that objective property values will remain unchanged until end-2027, eliminating volatility ahead of the next general election cycle.

Living Standards Index (Τεκμήρια) to Be Recalibrated

A long-awaited reform of Greece’s controversial “tekmiria” system—which estimates taxpayer income based on assets and spending—will finally materialize. A 30% reduction is planned for imputed income thresholds, affecting 1.8 million taxpayers.

This includes recalibrations based on housing, vehicle ownership, and personal status (single/married).

Additionally, modifications will be introduced to the minimum presumed incomes for self-employed individuals, with expanded eligibility for reduced thresholds based on geographic and demographic factors.

One-Off Benefit for Low-Income Households

Capping off the relief package, a year-end bonus will be distributed to vulnerable households and families with children, echoing previous support schemes such as “market passes” and energy subsidies. The exact amount and eligibility criteria will be finalized in the coming weeks.

A €2 Billion Bet on Economic Fairness

Though originally budgeted at €1.5 billion, the total cost of the measures is now projected to exceed €2 billion, thanks to strong tax collection performance and EU flexibility on defense spending exemptions.

With this package, the government aims not only to relieve financial pressure on Greek households but also to reset the national conversation amid political challenges and public frustration.

As Mitsotakis readies his message for Thessaloniki, the question remains: Will these measures be enough to shore up confidence and broaden support — or are they merely a prelude to deeper structural reforms ahead?

Source: pagenews.gr