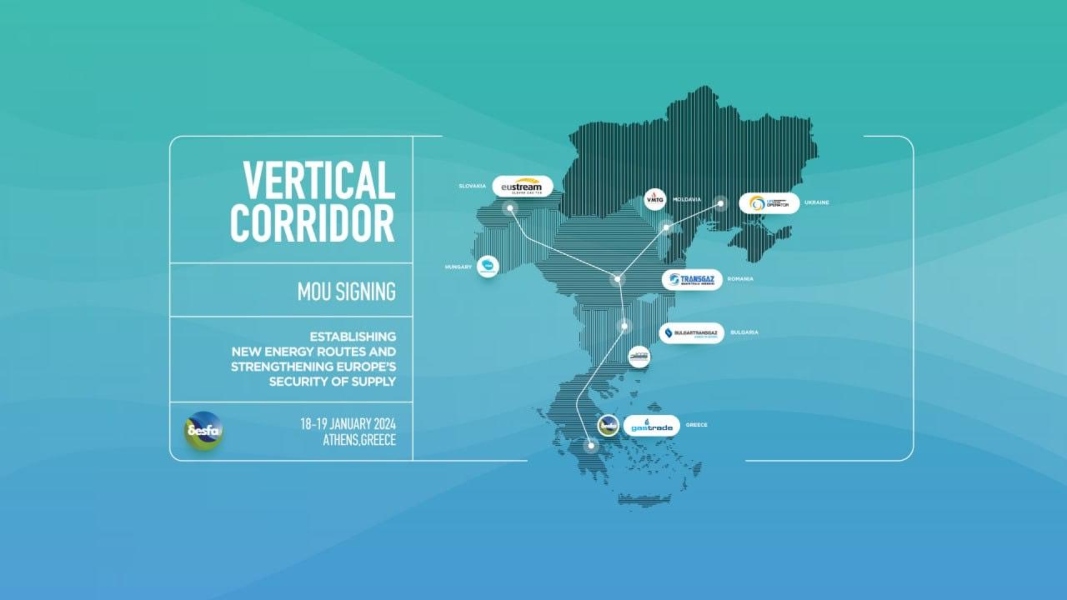

Crash Test for the Vertical Natural Gas Corridor: A Battle Against Time and Competition

Πηγή Φωτογραφίας: desfa//Crash Test for the Vertical Natural Gas Corridor: A Battle Against Time and Competition

The auction scheduled for January 26, 2026, to allocate capacity in the Vertical Natural Gas Corridor is rapidly becoming one of the most crucial tests for the future of the project. With growing uncertainty and increasing pessimism among market players, this auction is now seen as a “crash test” for the viability and commercial attractiveness of the project, which remains central to Greece’s strategy to become a key hub for the transportation of liquefied natural gas (LNG), primarily from the United States, to Southeastern Europe and Ukraine.

The Prospects and Challenges

The Greek government is strategically investing in the Vertical Corridor as a means to enhance energy security in the region, aiming to supply countries in Eastern Europe with LNG. However, the evolving market dynamics suggest that the project faces significant hurdles. The limited supply of natural gas, coupled with increased risk and escalating competitive pressure from alternative supply routes, is raising concerns among stakeholders.

Notably, the available quantities offered for booking in this auction have been significantly reduced compared to December, now at around 26,000 MWh per day, down from 51,000 MWh last month. Although the need for natural gas in the Balkans and Eastern Europe is spiking due to harsh winter conditions, the limited volumes and high tariffs are deterring serious players from participating.

Commercial and Political Challenges

The Vertical Corridor faces intense competition from alternative supply routes, primarily via Poland and Hungary, which offer lower transportation costs and shorter distances. The Ukrainian market, a key destination for the gas transported through the Vertical Corridor, is largely serviced by these alternative routes, further complicating the project’s commercial strategy.

Additionally, geopolitical tensions and volatility in energy markets are adding further uncertainty, with market participants becoming increasingly cautious about taking on such risks, especially given the high costs and the unstable international political environment. The EU is closely monitoring the regulatory aspect of the project, examining traders’ complaints regarding possible distortions of competition arising from the unified capacity booking system, which could impact the effectiveness of future auctions.

Strategy and Goals for the Future

The Greek government is actively trying to bolster efforts through bilateral agreements and investments, hoping that European cooperation will bear fruit. The agreement with Naftogaz, Ukraine’s energy company, remains pivotal for the future of the Vertical Corridor. If the intention agreement signed by DEPA with Naftogaz for the period of January–March 2026 is activated, it could boost demand and strengthen the commercial viability of the project.

However, the market continues to remain cautious and pessimistic about the immediate exploitation of the Vertical Corridor. There is an increasing need for both short-term and long-term strategies to increase demand and attract investments to ensure the project’s success.

The Future of Energy Security in Eastern Europe

The outcome of this auction is expected to have far-reaching consequences for energy security in Eastern Europe. While the prospects of the Vertical Corridor remain strategically important, its success will require significant interventions and adjustments, both in regulatory and commercial terms. The result of the January 26 auction may determine whether the project can emerge as a reliable and sustainable pillar of energy security for the region or whether it will face additional challenges and delays.

Sources:

- Press Release, DEPA

Διαβάστε όλες τις τελευταίες Ειδήσεις από την Ελλάδα και τον Κόσμο

Το σχόλιο σας