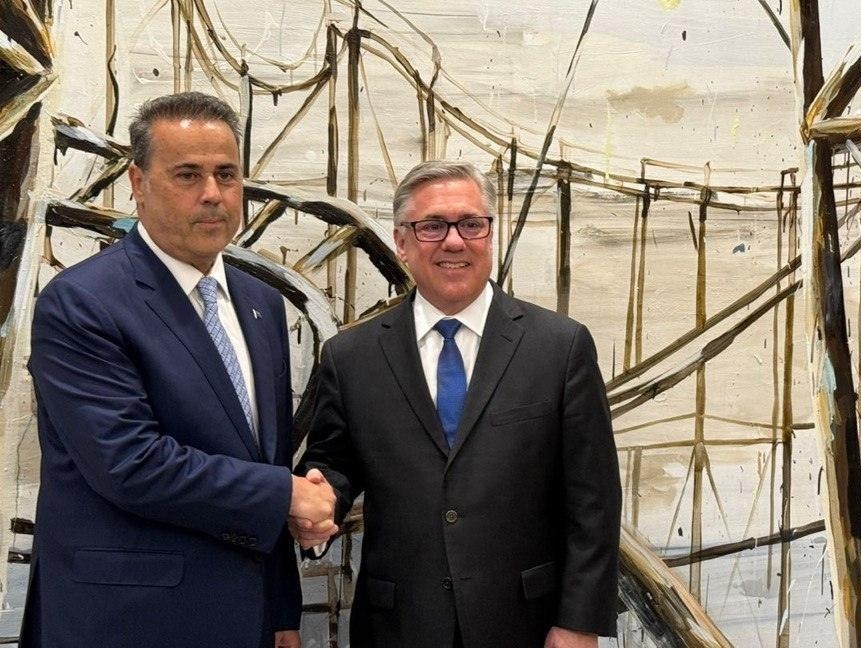

Chevron and Helleniq Energy Take Over Major Offshore Blocks in Crete and Peloponnese

Πηγή Φωτογραφίας: AP Photo/Chevron and Helleniq Energy Take Over Major Offshore Blocks in Crete and Peloponnese

Strategic Upgrade of the Energy Chessboard

Chevron Greece Holdings, in partnership with Helleniq Energy Holdings, has been officially designated as the preferred investor for four offshore hydrocarbon blocks in Crete and the Peloponnese, according to EDEYEP.

This development marks Greece’s largest gas exploration concession to date and elevates the country to a new strategic energy position, enhancing its geopolitical footprint in the region.

The blocks include:

- South of Peloponnese

- A2

- South of Crete I

- South of Crete II

Total area: over 47,000 square kilometers, located in regions that have attracted international interest due to potential reserves similar to the Zohr field in Egypt.

Accelerated Procedures and Political Signal

Although the initial timeline set the ratification of contracts by the end of 2025, market sources estimate the process could conclude as early as November, due to acceleration in:

- Contractual terms formulation

- Audit by the Court of Audit

- Parliamentary ratification

The rapid advancement sends a clear signal to international markets that Greece aims to reposition itself as a strategic energy hub and an attractive investment destination.

Multi-Phase Investment Plan

The program includes:

- 2D and 3D seismic surveys for approximately three years

- Geological specialization and drilling preparation for two years

- Pilot drilling operations for two years

- Development and exploitation phase, if economically viable reserves are confirmed

Preliminary estimates by EDEYEP suggest potential reserves could reach up to 680 billion cubic meters of natural gas, pending drilling results.

Geopolitical Dimension and Energy Security

The entry of Chevron, one of the world’s largest energy corporations, elevates Greece’s geopolitical profile and strengthens U.S. presence in the Eastern Mediterranean.

Context: Europe seeks diversification of gas sources and routes following the Russian energy crisis. Greece aims to:

- Establish itself as a hub for energy security

- Become a potential LNG exporter

- Serve as a bridge to the European gas market, positioning natural gas as a transition fuel in the next decade’s energy strategy

Investment Prospects and Corporate Interest

The agreement is expected to stimulate interest from listed companies with direct or indirect exposure to the upstream market, including:

- Helleniq Energy Holdings

- Motor Oil

- Energean

Additionally, LNG infrastructure providers, exploration service companies, and construction firms may become investment focal points during the development phase.

Challenges and Timeline

Despite strong institutional and investment momentum, challenges remain:

- Confirmation of commercially viable reserves is not guaranteed

- Environmental and social sensitivities are significant

- Tax framework and public participation rates will be carefully negotiated

Time from discovery to production: 7–10 years, depending on project scale and licensing procedures.

Source: pagenews.gr

Διαβάστε όλες τις τελευταίες Ειδήσεις από την Ελλάδα και τον Κόσμο

Το σχόλιο σας